Welcome to NavFile’s Walt Disney Company Financial Analysis report/article for the third quarter of 2020. This financial analysis report of Disney’s quarter is an interesting one due to the significant impact that the COVID-19 situation has had on the company’s operations. As with all of our reports on The Walt Disney Company, a PowerPoint presentation in PDF format is also part of the article. The research for this report has been completed by David Aughinbaugh II, our research analyst.

The Walt Disney Company Financial Analysis Q3 2020 Overview

This report covers the company’s revenue and income results to start with. After that section, an analysis of performance during the quarter compared to the expected results is covered. A key information section is covered next that goes over important information. An analysis of the performance of each segment of the company is reviewed. Cash flows and what is expected going forward is featured as the last section of this report.

The Walt Disney Company 3rd Quarter 2020 Earnings Summary

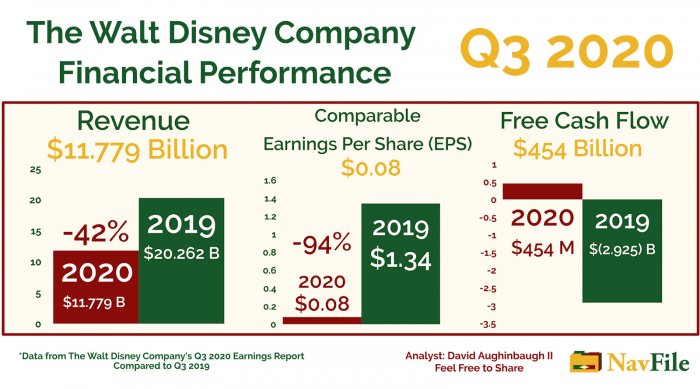

On August 4th, 2020, The Walt Disney Company reported its third quarter 2020 earnings. As a result of the COVID-19 situation in the United States, the company reported results that were significantly below last year’s results. Revenues came in at $11.779 billion, a 42 percent decrease from last year’s $20.262 billion. Net income (loss) was $(4.718) billion compared to a profit of $1.430 billion in 2019. Diluted earnings per share (EPS) from continuing operations was $(2.61) compared to a $0.79 profit per share in the prior year’s quarter. Diluted EPS excluding items that affect comparability (comparable EPS) was $0.08 for the quarter, a 94 percent decline from last year. In 2019, comparable EPS was $1.34.

Walt Disney Co.’s segment operating income came in at $1.099 billion for the quarter compared to $3.952 billion in 2019 Q3. That represents a 72 percent decline in earnings for the quarter. Cash provided by operations was $1.162 billion, which was a significant increase from 2019’s negative $1.748 billion ($2.910 billion difference). Free cash flow for the quarter rose to $454 from $(2.925) billion in 2019 Q3.

Financial Analyst Expectations

For the quarter, analysts on Wall Street expected the company to lose $0.64 per share (comparable EPS) and have revenue of $12.37 billion according to CNBC. The Walt Disney Company beat earnings expectations by $0.72, which was a significant beat (reported $0.08 comparable EPS/113 percent above). Revenues were below expectations; however. Revenues missed expectations by $590 million, which was 5% above the $11.779 billion that the firm reported.

2020 Q3 The Walt Disney Company Financial Analysis Presentation

Slideshow/Powerpoint Presentation for The Walt Disney Company's 2020 Third Quarter Earnings (Financial Analysis) (PDF Format).

The Walt Disney Company Reviews Its Tough Financial Situation With Bright Spots

During the earnings conference call, the company reviewed the situation that it is in due to COVID-19.

The company’s parks are being impacted significantly by the closures the company has had to implement. Walt Disney World Resort opened after the quarter so results do not have information on the operational performance of the parks. On the conference call, Disney did say that Walt Disney World is operating above costs after the reopening. However, guest levels are below what the firm expected that they would be. Fifty percent of guests to the resort are traveling from outside of the state. Guest spending per capita is very strong according to Christine McCarthy, CFO of Disney. Disney is expecting that its performance at Parks and Resorts will improve strongly once the COVID-19 situation starts to wind down.

During the quarter there were some bright spots. The company’s streaming services division was able to hit 100 million subscribers. Disney+ continues to do well growth-wise as Walt Disney Co. now has 60.5 million subscribers for that service. In every geographic market that they have entered, they have exceeded their internal projections. Disney is continuing with the international expansion of Disney+ and will be rolling out the service in Belgium, the Nordic region, Luxembourg, Portugal, and Latin America later this year. Disney+ is also helping Studio Entertainment with its operations as Disney will be releasing the live-action version of Mulan on Disney+ for $29.99. Studio Entertainment’s operations have significantly been affected by the closure of movie theaters around the world. When asked if the company may start launching movies on Disney+ in addition to theaters, Bob Chapek, CEO of the company, said that the company does not plan to.

Media Networks was another bright spot for the company as reduced expenses helped the segment deliver growth in operating income. Cable networks’ results were positively impacted by the lower cost of programming and production due to the deferral of MLB and NBA games.

Most of the conference call was dedicated to Disney’s Direct-to-Consumer segment with streaming service taking the forefront. Streaming will continue to be at the forefront due to the current situation and the growth that the division is projected to bring for the company.

Studio Entertainment was mentioned briefly during the call. That segment has also been impacted greatly and saw its operating income decline for the quarter. No new films were also released during the quarter.

The Walt Disney Company is facing a challenging environment; however, things are getting better according to the company.

Above is a graphic the showing the financial performance of The Walt Disney Company during the 3rd quarter of 2020 by David Aughinbaugh II. Revenue, comparable EPS, and free cash flow are covered in the graphic. Please feel free to share.

The Walt Disney Financial Analysis Q3 2020 (3rd Quarter)

Continuing the trend that started in the second quarter, The Walt Disney Company reported a loss for the quarter. For comparable EPS, the company was able to have a small profit of $0.08 per share. That was a 94 percent decline from 2019. Regular EPS was a loss of $1.17 per share or $4.718 billion. Segment operating income was impacted by a $3.5 billion loss for Parks, Experiences, and Products. Segment operating income for all of the company’s operations was impacted by $2.9 billion. The Walt Disney Company Reported that segment operating income for the quarter was $1.099 billion, a 72 percent decline from last year.

This was Disney’s worst quarter in a long time as its Parks, Experiences, and Products and Studio Entertainment segments were greatly impacted by the COVID-19 situation. Parks, Experiences, and Products was affected the most as resorts remained closed and merchandise sales were down for the quarter. Studio Entertainment was still able to report a profit despite the closure of movie theaters. Media Networks had a solid quarter as it reported higher operating income due to significantly lower expenses. Direct-to-Consumer and International was able to gain subscribers; however, its revenues only increased by 2 percent and its losses increased 25.6 percent.

Parks, Experiences, and Products (PEP) was the main reason why segment operating income declined dramatically. Revenues were down 85 percent and income went significantly into negative territory. Net income for The Walt Disney Company was significantly impacted by a $4.953 billion impairment charge for its International Channels and a $94 million restructuring charge. During the quarter Disney closed several international channels, which resulted in them incurring the impairment charges. Those charges alone represented 43 percent of the firm’s revenues for the quarter. Combining those charges with Parks, Experiences, and Products results led the firm to have a loss for the quarter.

Impairment charges, PEP’s loss, and reduced profit at Studio Entertainment were the main factors behind the net loss for Disney. Studio Entertainment and PEP’s loss were responsible for the 94 percent decline in comparable EPS.

Continued Losses

Right now, Disney has been able to control expenses by shutting down parks and resort operations and reopening resorts inline with demand. Costs at Media Networks and Studio Entertainment have been controlled very well as the company was able to reduce costs significantly by not producing new shows and movies. It will have to be seen if losses decline in the next quarter and if the company can return to profitability (net income).

Segment Operating Performance

Segment operating income came in at $1.099 billion, a 72 percent decline from 2019 Q3. As with last quarter, Parks, Experiences, and Products led the decline by swinging to a loss ($1.960 billion loss). Studio Entertainment was next with a 16 percent decline in operating income. Media Networks had an impressive quarter by reporting a 48 percent increase in operating income. Direct-to-Consumer and International continued to have increased losses (26 percent increase); however, at a reduced rate when compared to last quarter’s comparisons. Revenues for Direct-to-Consumer and International increased by 2 percent compared to last year, which is a slower increase compared to last year’s quarter.

Financial Analysis Review

The 3rd quarter of 2020 proved to be another challenging quarter in which the company had to close down its theme parks and stop the release of its films. Although Parks, Experiences, and Products had substantial losses during the quarter, Media Networks was able to outperform based on a sharp reduction of costs. Studio Entertainment also was able to slow losses through the reduction of costs, which was a good development. An impairment charge for the closure of international channels played a major role in the company reporting a loss for the quarter. The Walt Disney Company has taken steps to ensure it can manage cash burn. Disney has stabilized operations and is now in position for a rebound in economic activity.

Key Information – 2020 Q3 Financial Results

The economic impact of COVID-19 has continued to impact the company’s results with Parks, Experiences, and Resorts taking the biggest hit by far.

Diluted EPS was a loss of $2.61 and comparable EPS was $0.08, a 94 percent decline from last year’s quarter.

Revenues were $11.779 billion, a decline of 42 percent from last year.

Free cash flow was $454 million for the quarter compared to an outflow of $2.925 billion last year. The company has raised a significant amount of cash and has over $23 billion on hand.

Parks, Experiences, and Products was negatively impacted by $3.5 billion by the effects of COVID-19.

Walt Disney World Resort was able to begin opening up after the quarter ended. The company has been able to operate the resort profitably; however, guest levels are lower than they expected

Disney was impacted by $2.9 billion overall (including all segments) due to COVID-19.

Media Networks was able to deliver a 48 percent increase in operating income due to reduced costs. Production costs were down as the company did not have to spend lots of money on new shows and programming.

ESPN was up for the quarter due to lower programming costs as NBA and MLB games have been deferred to the next quarter.

Broadcasting revenues and operating income were up double digits for the quarter (12 and 55 percent). Higher affiliate rates and lower marketing and programming costs were behind the increases.

Direct-to-Consumer and International took the spotlight in the quarter as its streaming services division was able to reach 100 million subscribers. Disney+ reached 60.5 million subscribers on the day before the earnings conference call.

The company has put its focus into Direct-to-Consumer and International as it is gaining business due to the economic shutdowns around the world.

Direct-to-Consumer and International reported an increased loss of $706 million (26 percent increase from last year). Revenues increased by 2 percent.

A major factor in the loss that the company reported (regular EPS) was the impairment charge the company incurred during the quarter. A $4.953 million charge was taken as a result of the closure of International Channels Business’ channels. The charge and a $94 million restructuring cost represented 43 percent of the revenues for the quarter.

The company has been able to reduce costs that have put it on more stable ground. Cost reductions at Media Networks have helped that segment significantly. Cost-cutting at Studio Entertainment has helped to reduce the segment’s losses.

Going forward, the company is in a position to weather the current situation and is ready to capture an economic rebound when it occurs.

Segment Financial Results and Financial Analysis

Parks, Experiences, and Products

The response to COVID-19 has greatly affected Parks, Experiences, and Products operations. COVID-19 resulted in a $3.5 billion negative impact to the segment. Revenues were down 85 percent to $983 million. The segment lost $1.960 billion in the quarter. All of Disney’s U.S. parks, cruise ships, and Disneyland Paris were closed for the entire quarter. Shanghai Disney Resort reopened during the quarter and Hong Kong Disneyland Resort reopened and was then closed during the quarter. Licensing and retail were also down for the quarter due to lower licensing revenue and the closure of Disney Stores.

The closure of most of the division's operations led to a large loss in the quarter.

Walt Disney World Resort reopened shortly after the quarter and the company reports that it making a positive contribution; however, guest demand has been less than expected.

Studio Entertainment

Studio Entertainment was the next division that was affected by the COVID-19 situation. Movie theaters were closed during the quarter and the firm did not release any new films. Revenues were down 55 percent to $1.738 billion. Segment operating income was down 16 percent to $668 million. Operating income did not decline as much as revenue due to the cost savings the company was able to gain from not releasing any new films in the quarter. Increased TV/SVOD distribution also helped. The increase in TV/SVOD distribution was due to sales of content to Disney+, which included Onward and Star Wars: The Rise of Skywalker.

A positive for Studio Entertainment was that it did not have a sharp decline in operating income even though movie theaters were closed.

Media Networks

Media Networks was the company’s best-performing segment as it was able to have double-digit gains in operating income. For the quarter, operating income increased 48 percent to $3.153 billion. Revenues were down 2 percent to $6.562 billion on the other hand. Media Networks was able to have sharp increases in operating income due to lower programming and advertising costs combined with little revenue declines. Inside of Media Networks, Cable Networks saw its revenues decline by 10 percent to $4.034 billion. Operating income rose by 50 percent to $2.459 billion. Broadcasting’s revenues increased by 12 percent to $2.528 billion and operating income increased 55 percent to $447 million.

Cable Networks Review

Even with the effects that COVID-19 had on entertainment, Cable Networks was able to benefit from the economic shutdown. Operating income for the division increased by 50 percent mostly due to lower costs for programming and production. ESPN and FX Networks were the two areas that led the company to have good performance in the quarter. ESPN benefited from the deferral of rights costs for NBA and MLB programming. There was also an increase in affiliate revenue growth combined with a decline in subscribers. Advertising revenue also declined due to a decrease in sports programming. FX Networks’ rise was caused by lower programming and marketing costs.

Broadcasting

Broadcasting saw its revenues increase by 12 percent to $2.528 billion and its operating income increase by 55 percent to $477 million. Following the same trend as Cable Networks, the large increase in operating income was caused by lower programming costs, increased affiliate revenue (increased rates), increased program sales, and lower marketing costs. Production of new shows was shut down in the quarter, which allowed Broadcasting to save money. There was also lower advertising revenue and lower average network viewership in the quarter.

Equity in the Income of the Investees

Equity in the Income of the Investees saw its income to the company increase 13 percent to $217 million. The increase was the result of higher income from A+E Television Networks and lower programming and marketing costs.

Direct-to-Consumer and International

Direct-to-Consumer and International had a good quarter in which the company was able to add more subscribers to its streaming services. Revenue came in at $3.969 billion (up 2 percent) and operating losses increased 26 percent to $706 million. Operating losses increased due to costs with the continued launch of Disney+. ESPN+ and Star were able to slightly offset the losses, however. Star increased its results due to lower programming expenses and ESPN+ was up on subscriber growth and increased income from UFC pay-per-view.

2020 Q3 Cash Flow Analysis

Cash provided by operations for the quarter was $1.162 billion, up from negative $1.748 billion in 2019. Investments in parks, resorts, and other property declined by $469 million (39.8 percent). Free cash flow came in at $454 million compared to a negative $2.925 billion in 2019.

Year-to-date, cash provided by operations was $5.949 billion, up from $4.266 billion in 2019 (39.5 percent). Investments in parks, resorts, and other property was $3.293, down from $3.567 billion (7.6 percent decline). Increased account receivable collection was the main factor in the increase in cash flow. Lower segment operating income and increased expenses on television and film productions slightly offset the increased cash flow.

Financial Performance Overview of The Walt Disney Company

It was a rough quarter for The Walt Disney Company. It reported a net loss; however, was able to manage to record a gain with comparable EPS. COVID-19 affected its Parks, Experiences, and Products and Studio Entertainment businesses greatly. Media Networks and Direct-to-Consumer and International were able to help stabilize the company, however. Media Networks had a 48 percent increase in its operating income, which helped the company greatly. All of the other segments had a decline in operating income. An impairment charge for the closure of some international channels also weighed heavily on the company’s results. That charge combined with a restructuring charge was 43 percent of Walt Disney Co.’s revenue for the quarter.

Direct-to-Consumer and International continued to be the focus of the company’s operations where it reached 100 million subscribers and Disney+ reached 60.5 million subscribers by the earnings conference call. Disney is focused on continuing the growth of its streaming services and will be releasing Mulan on the platform due to the current situation.

Disney’s results and statements indicate that the company has entered into a stabilized state that will allow it to keep its expenses low to reduce any future losses. Once people begin to start traveling again, the company is in a position to capture future demand as Walt Disney World Resort has reopened. Walt Disney World is contributing positively to the firm, which is good news. As long as Walt Disney World Resort can remain open, the company will be able to capture any increased demand that occurs in the next couple of months.

Although the company had a tough quarter, the company has stabilized its operations.

Future Analysis and What to Watch For

The Walt Disney Company’s future will depend on when the economic shutdown starts to end. Parks, Experiences, and Products make up a large portion of the company’s operations. If that division is not able to return to levels that are approaching normal, then the company will not be able to return to its former self. Disney is one company that has not done well in the current environment, even though it has a lot of at-home entertainment services. Experiences at its parks and resorts play a big role in the overall success of the company. The entertainment segments of the company can’t replace Parks, Experiences, and Products. Guest levels will be the key area to watch. If travel demand keeps going up, The Walt Disney Company will find itself recovering from the COVID-19 situation.

Information for this article is from:

- The Walt Disney Company Earnings Report and Transcript. It can be found here.

- CNBC article regarding the Q3 earnings here.