Welcome to our Walt Disney Company Financial Analysis for the 1st quarter of 2020. In this article, David Aughinbaugh II, our research analyst, reviews the results for the quarter that covers all of the company’s segments. In addition to the information that is part of this article, a PowerPoint presentation is also available below that covers the quarter in a shorter format.

Q1 2020 Coverage Overview

The first part of this article/report covers The Walt Disney Company’s top line (revenue) and bottom-line (income) results. After that section is an analysis of the overall performance of Disney in the quarter and what analysts were expecting the company to report. A key information section is then provided. That section covers the most important information about the quarter. Following the key information section is an analysis of the results of each segment. A cash flow analysis is then provided, which covers how cash was moved in the quarter. At the end of the article, David provides an analysis of how the quarter beat expectations and where the company is headed.

Q1 2020 The Walt Disney Company Financial Summary

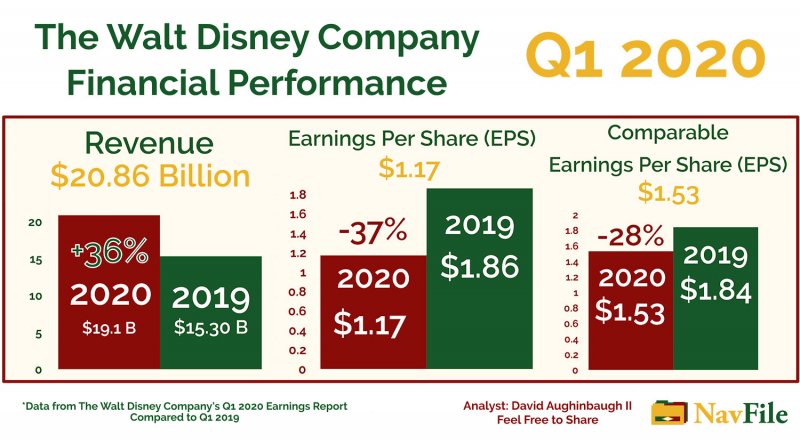

On February 4th, 2020, The Walt Disney Company reported its earnings results for the first quarter of the 2020 fiscal year. Revenue for the quarter was $20.858 billion and net income was $2.133 billion from continuing operations. Revenues were up 36 percent from last year’s quarter ($15.303 billion). Net income was down 23 percent when compared to last year’s quarter ($2.788 billion). Diluted earnings per share (EPS) was $1.17, down 37 percent from Q1 2019’s $1.86. Diluted EPS that excludes items affecting comparability came in at $1.53, down 17 percent from last year’s $1.84 EPS.

Segment operating income was $4.002 billion, up 9 percent from Q1 2019 ($3.655 billion). Cash provided by operations declined by 22 percent to $1.630 billion from $2.099 billion in 2019. Free cash flow declined to $292 million, a 68 percent decline from $904 million in 2019.

Company Announces Disney+ and Streaming Services Subscriber Counts

In its earnings results, Disney also announced that Disney+ has 26.5 million subscribers. On the earnings conference call, Bob Iger announced that the company had 28.6 million subscribers on the day before the call. That was a highly anticipated announcement which provided insights on how the streaming service is doing with customer growth. In addition, the company also started providing information on the average revenue per customer for the service, which was $5.56 for the quarter.

Analyst Expectations for the Quarter

The average analyst expectations for revenue were $20.79 billion and expectations for earnings per share were at $1.44 (comparable EPS) according to CNBC. Revenues were basically inline with expectations as they only beat expectations by a fraction of a percent (0.3%). Comparable EPS beat expectations by 9 cents and was 6.25 percent above estimates.

Q1 2020 The Walt Disney Company Financial Analysis - Presentation

Slideshow/Powerpoint Presentation for The Walt Disney Company's 2020 First Quarter Earnings (Financial Analysis) (PDF Format).

The Walt Disney Company Financial Analysis Q1 2020 (1st Quarter)

The Walt Disney Company reported another solid quarter that beat analyst expectations for the quarter. Revenues were inline; however, EPS was 6.25 percent above expectations. The company’s top three segments had solid performance that allowed the company to perform well in the quarter. Direct-to-Consumer and International combined with eliminations slowed increases in segment operating income due to increases in losses when compared to last year. EPS and comparable EPS were down significantly from last year, however. Increased costs and expenses and an increased diluted share count were the main contributors to the lower EPS performance. An increase in the outstanding shares in the marketplace played a significant role in the lower EPS results. Outstanding shares increased significantly in the 3rd quarter of 2019 as part of the 21st Century Fox deal. Increased diluted share count has actually been affecting results since the 3rd quarter; however, was not mentioned in our previous reports. Costs and expenses were the main drivers of lower net income and EPS as they increased by 51.6 percent from last year.

Segment operating income was up 9 percent from 2019 Q1. Media networks, Studio Entertainment, and Parks, Experiences, and Products all had solid performance that allowed the company to have growth in operating income. Studio Entertainment had an excellent quarter in which operating income was up 207 percent from last year’s quarter. Media Network’s and Parks, Experiences, and Product’s operating income were up 23 percent and 9 percent respectively. Direct-to-Consumer and International saw losses increase by 409 percent as the company spent increased amounts of money on the launch of Disney+; however, revenues increased by 334 percent.

The Walt Disney Company performed well for the quarter with Studio Entertainment and Media Networks leading the way in operating income growth. Disney+ was launched in the quarter and the company reported that it had 26.5 million subscribers in the quarter; however, CEO Bob Iger announced that it had 28.6 million subscribers on the earnings conference call. Park, Experiences, and Products also had solid increases in revenue and operating income growth.

Above is a graphic with charts that compares the revenue, earnings per share (EPS), and comparable EPS for the 1st quarter of 2020 compared to Q1 2019. The chart graphic is by David Aughinbaugh II.

2020 Q1 Financial Results – Key Information

The company is still working on the integration of 21st Century Fox into its operations. As a result, the company reported increased costs and expenses for the quarter (51.6 percent). That was the main driver of lower net income in the quarter.

EPS was impacted on a quarter to quarter comparison due to the increased costs and expenses and the addition of outstanding shares that the company issued as part of the 21st Century Fox (TFCF) deal.

Studio Entertainment was a big winner in the quarter as its operating income was up 207 percent and revenue were up 106 percent.

Studio Entertainment’s Frozen II, Maleficent: Mistress of Evil, and Star Wars: The Rise Of Skywalker movies all had great results that allowed the firm to easily rise above last year’s results.

Media Networks and Parks, Experiences, and Products reported solid numbers in the quarter. Media Networks had a 23 percent increase in operating income and a 24 percent increase in revenues. Parks, Experiences, and Products had a 9 percent increase in operating income combined with an 8 percent increase in revenues.

Media Networks’ Cable Networks had a 16 percent increase in operating income that was due to the inclusion of 21st Century Fox (TFCF) companies in the results. There was a decrease at ESPN, however.

ESPN was down due to higher production and programming costs combined with lower advertising revenue.

Broadcasting operating income increased 41 percent due to the inclusion of TFCF operations, program sales, and the timing of new accounting guidance in the quarter. Legacy operations were down for the quarter.

Parks, Experiences, and Products’ growth were due to higher income from merchandise licensing and domestic parks and resorts. Lower results at international parks and resorts affected results, however.

Direct-to-Consumer and International had a 409 increase in losses; however, there was also a 334 percent increase in revenues in the quarter.

Disney+ was launched in the quarter and had 26.5 million subscribers by the end of the quarter. On the Monday before the earnings conference call, the company had 28.6 million subscribers. The service’s subscriber count has exceeded expectations.

The increase in losses for Direct-to-Consumer and International was due to launch costs for Disney+, Hulu consolidation, and an increase in losses at ESPN+.

Cash Flow and Free Cash Flow was down 22 percent for the quarter due to increased film and television expenses, higher restructuring and interest payments. Higher segment operating income helped to slightly offset the decline. Free Cash Flow was down 67.6 percent and was impacted by higher investments in parks, resorts, and other property (12 percent increase).

The firm had another solid quarter as it beat analyst estimates for comparable EPS and was virtually inline with revenue expectations.

Segment Financial Results

In this section an overview of the performance of each segment (division) of the company is covered.

Studio Entertainment

Building upon last year’s quarter, Studio Entertainment had a spectacular quarter with over a 100 percent growth in revenues and income. Revenues for the quarter were $3.8 billion, an 111 percent increase from $1.8 billion in 2019 ($2 billion increase). Operating income came in at $948 million which was a 207 percent increase from $309 million in 2019 ($639 million increase).

The increase in operating income was due to the success of the movies that were released in the quarter and legacy TV/SVOD operations. TFCF businesses did record a loss that slightly affected results, however. Frozen II, Star Wars: The Rise of the Skywalker, and Maleficent: Mistress of Evil films all had great results that easily beat last year’s movie slate. TV/SVOD experienced growth due to the sales of content to Disney+. A decrease in pay television sales to third parties lowered results, however. Also, 21st Century Fox’s film lineup, which included Spies in Disguise, Terminator: Dark Fate, and Ford v. Ferrari, and general and administrative costs caused TFCF businesses to record a loss for the quarter.

Media Networks

Media Networks had a great quarter that included a 24 percent increase in revenues to $7.4 billion and an operating income increase of 23 percent to $1.6 billion. Cable Networks, Broadcasting, and Equity in the income of the investees all had segment operating income increases for the quarter. Information on the main divisions of the segments is covered below.

Cable Networks

Cable Networks reported results that included a 20 percent increase in revenues to $4.766 billion ($780

million increase). Operating income for the division was up 16 percent to $862 million ($119 million increase). The increase in operating income for the quarter was the result of the merger of the TFCF operation into the division. The increase was partly offset by a decline at ESPN.

ESPN was impacted by higher production and programming costs and lower advertising revenue. Those results were countered by higher affiliate revenue, however. Increases in rates for NFL, College Football Playoffs, and other college sports and costs for the ACC Network were responsible for the higher production and programming costs. Lower viewership caused a decline in advertising revenue. Affiliate revenue was up due to higher contractual rates; however, it was slightly offset by a decrease in subscribers.

Cable Networks had a good quarter that was mostly driven by the inclusion of TFCF businesses. Disney’s main operations did not perform as well, however. Those operations had lower viewership and ESPN was impacted by higher costs.

Broadcasting

During the quarter, Broadcasting had solid results that included a 34 percent increase in revenues to $2.595 billion ($660 million increase) and a 41 percent increase in operating income to $575 million ($167 million increase). The rise in operating income was due to the merger of TFCF operations into the division and a timing benefit from new accounting guidelines. Lower results at The Walt Disney Company’s legacy operations dampened the rise in operating income, however. The decrease at legacy operations was caused by lower ABC studios program sales and higher programming and production costs. On the other hand, affiliate revenue did climb because of higher rates. There was also lower advertising revenue that was due to declines at company owned television stations and lower network viewership. ABC Studios was affected by comparisons to the sale of The Punisher last year.

Equity in the Income of the Investees

Income for this division increased 8 percent to $193 million ($14 million increase). The source of the higher was from A+E Television Networks’ higher advertising revenue and lower programming costs.

Media Networks Analysis

Media Networks had a good quarter based on the double digit rises in revenues and operating income. Operating income growth was significantly lower then revenue growth, however. Most of the growth in the quarter came from the inclusion of 21st Century Fox operations in the results and an adjustment of accounting guidelines. The main Disney operations were mostly down for the quarter, which is an interesting development. ESPN and legacy operations are two areas to watch as their results were down. Fox operations helped Media Networks post positive results; however, Legacy/Disney operations were down for the quarter.

Parks, Experiences, and Products

For the quarter, Parks, Experiences, and Products had revenues of $7.396 billion, an 8 percent increase in revenues ($572 million increase). Operating income came in at $2.338 billion, a 9 percent increase from last year ($186 million increase). Income growth was due to increases at U.S. parks and resorts and merchandise licensing. Income was slightly affected by declines at international parks and resorts.

Higher results at domestic parks and resorts were due to higher guest spending and increased attendance. There were higher costs that impacted results also. Revenues were up 10 percent and operating income up 6 percent for domestic parks and resorts. Attendance was up 2 percent and guest spending was up 10 percent (per capita). Per room spending at U.S. resorts was up 4 percent and the occupancy rate was 92 percent. Guest spending increases were mostly due to higher ticket prices and higher food, beverage, and merchandise spending. Higher costs were from the launch of Star Wars: Galaxy’s Edge and wage increase for union cast members.

International parks and resorts results were impacted by the performance of Hong Kong Disneyland, which was down for the quarter. Shanghai Disney Resort had growth for the quarter, however. The company did not report on information on their other parks. The company is expecting that the Coronavirus will impact second quarter and full year results.

Products had higher results due to an increase in revenue from Frozen, Toy Story, and Star Wars. Operating income was up 25 percent for Consumer Products as a result of the licensing performance. Frozen and Star Wars were the main merchandise platforms that allowed Consumer Products to have double digit operating income growth.

Parks, Experiences, and Products had a solid quarter with growth in revenues and operating income. Operating income growth exceeded revenues by 1 percent, which was a good sign. Attendance was up at domestic parks, which was another positive. The company did not provide information on how the other parks did during the quarter.

Direct-to-Consumer and International

Direct-to-Consumer and International’s quarter consisted of significant increases in revenues and losses. Revenues were up 334 percent from $918 million to $3.987 billion ($3.069 billion increase). Operating losses for the quarter were $693 million, up 409 percent from $136 million in the last quarter ($557 million increase). Costs for the launch of Disney+, the merger of Hulu into the segment, and increased losses at ESPN+ were the main factors that caused the increase in operating losses.

At the end of the quarter, Disney had 26.5 million subscribers for Disney+. On the conference call, Bob Iger announced that the company had 28.6 million subscribers on the day before the conference call. The Walt Disney Company is expecting that subscriber growth for Disney+ will come from international markets in the near term. The company is also expecting that year-over-year losses will increase by $520 million as the company continues to expand its streaming service to other markets.

ESPN+ had 6.6 million subscribers and Total Hulu subscribers were 30.4 million at the end of the quarter. The average revenue per ESPN+ subscriber was $4.44 and $5.56 for Disney+. ESPN+ revenue per subscriber was down from $4.67 in last year’s quarter because of more customers opting for Disney’s bundle subscription. Hulu’s average revenue per subscriber was down from $14.49 for the same reason.

Withstanding the operating loss, Direct-to-Consumer and International had a great quarter as Disney+ was able to gain over 25 million subscribers in its first quarter, which was ahead of the company’s own expectations. Revenue gains also easily out paced the increases in losses.

Cash Flow Analysis: Quarter Cash Flow Analysis

Cash provided by operations was at $1.630 billion for the quarter, a $469 million or 28.77 percent decline from last year’s quarter. Free cash flow was $292 million for the quarter, down $612 million from last year (67.7 percent decline). Cash from operations was down due to increased film and television development spending and interest and restructuring payments. Segment operating income slightly offset the decline, however. The driver of those results was the merging of Hulu and TFCF operations into the company. Free cash flow was impacted by an increase in investments in parks, resorts, and other property. Investment in that area increased by $143 million from last year, a 12 percent increase to $1.338 billion. Free cash flow was mostly affected by a drop in cash provided by operations, however.

The Walt Disney Company’s Solid Quarter Overview

The Walt Disney Company had another solid quarter that beat expectations for earnings. The company was able to beat expectations by having good results across the board from all of its segments. The company’s Direct-to-Consumer and International segment saw its Disney+ service reach 26.5 million subscribers by the quarter-end and 28.6 million on the day before the earnings announcement. Right now, the company is ahead of its projection to have 60 to 90 million customers by 2024 for the service. Studio Entertainment was the big winner in the quarter, however. That segment had a triple-digit percentage increase in revenue and income. Media Networks had an over 20 percent increases in revenues and operating income; however, it was mostly based on the inclusion of 21st Century Fox in the results. Parks, Experiences, and Products had a great quarter that included increases in revenue, operating income, income from licensing activities, and attendance at domestic parks.

Future Analysis – What to Watch Going Forward

Disney is performing very well for a company of its size. Once the integration costs of 21st Century Fox subside, the company will be able to leverage that acquisition to help the firm grow. Overall, the company’s divisions are all having solid performance. There are some headwinds that could affect the growth of the company, however.

Even with the solid results, the company is starting to face some headwinds. One of them has to due with the virus that started in China and has caused them to close down Shanghai Disney Resort and Hong Kong Disneyland. Those parks remain closed as of the time this article was posted.

Right now, it is unclear how the growth of the Direct-to-Consumer and International division will impact the company’s overall results. Disney seems to be focused on the international market as the main area that will bring growth to the company in the future.

Media Networks is still experiencing some minor issues with TV subscribers and costs at ESPN. We believe that Direct-to-Consumer and International’s streaming services are Disney’s answer to the counter the slower performance in Media Networks.

Parks, Experiences, and Products continues to perform well; however, concerns in Asia and slow attendance growth may be some areas to watch going forward.

Studio Entertainment had an awesome first quarter; however, can the segment keep up its performance for the next quarter and the year.

Also, right before this article was posted, Bob Iger stepped down as CEO of The Walt Disney Company and Bob Chapek was named CEO of the company. Mr. Iger will stay on as the Executive Chairman of the company until 2021 and assist Mr. Chapek with the transition to CEO. In addition, Bob Iger will work on developing the creative side of the company as Executive Chairman. It will be interesting to see what direction the company takes under the leadership of Mr. Chapek.

Sources

- The Walt Disney Company 2020 Q1 Earnings Report: https://thewaltdisneycompany.com/app/uploads/2020/02/q1-fy20-earnings.pdf

- CNBC – Analyst Expectations: https://www.cnbc.com/2020/02/04/disney-disearnings-q1-2020.html

- The Walt Disney Company 2020 Q1 Earnings Conference Call: https://thewaltdisneycompany.com/app/uploads/2020/02/q1-fy20-earnings-transcript.pdf