Welcome.

The following is The Walt Disney Company Financial Analysis for the 2nd quarter of 2020 (Q2 2020). This article covers the results for the quarter and an analysis of the rapid change/decline in the company’s results. A PowerPoint presentation can also be found below that covers the information contained in this article. David Aughinbaugh II, our research analyst, is the author behind the following research.

The Walt Disney Company Financial Analysis Q2 2020 Overview

The beginning of this report covers Disney’s revenue and income results. Following the revenue and income results is an analysis of the performance of The Walt Disney Company for the quarter and a comparison of what was expected for the company. Next is the key information section that covers the important details of the quarter in a bullet point format. After that section is an analysis of how each of Disney’s segments performed in the quarter. A review of Cash Flows and what to expect going forward in this unprecedented environment is covered last.

The Walt Disney Company 2nd Quarter 2020 Financial Summary

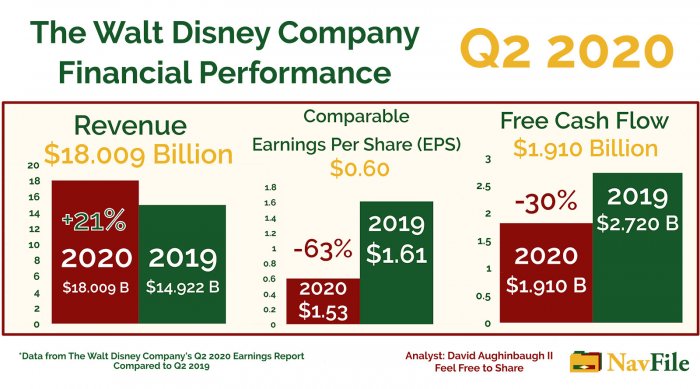

The Walt Disney Company reported its quarterly results for the 2nd quarter on May 5th, 2020. The results were highly anticipated as the company has been significantly impacted by the economic shutdown that has affected the world. For the 2nd quarter, the company reported that revenues came in at $18.009 billion, a 21 percent increase from last year ($14.922 billion). Net income was $475 billion, a decrease of 91 percent from last year ($5.431 billion). Diluted earning per share (EPS) from continuing operations was $0.26, down 93 percent from last year ($3.53). Diluted EPS excluding items that affect comparability (comparable EPS) was $0.60, down 63 percent from last year ($1.61).

Segment operating income came in at $2.416 billion, a 37 percent decrease from last year’s $3.816 billion. Cash provided by operations was $3.157 billion, a 19 percent decline from $3.915 billion in 2019. Free cash flow declined 30 percent from $2.720 billion to $1.910 billion.

2020 Q2 The Walt Disney Company Financial Analysis Presentation

Slideshow/Powerpoint Presentation for The Walt Disney Company's 2020 Second Quarter Earnings (Financial Analysis) (PDF Format).

Company Discusses Impact From The Economic Shutdown

The main focus of this earnings report was how the company was affected by the economic shutdown. The earnings report contained a quote from CEO Bob Chapek that mentioned that the shutdown “has had an appreciable financial impact” on several of their businesses. In the earnings conference call, the Disney team went into more detail on how they see the company exiting out of the economic closure. Executive Chairman Bob Iger mentioned that the shutdown has hit Disney hard and he believes that the company has a history of being resilient. Mr. Iger also explained that most of their operations are shut down; however, their creative teams are still working on projects. Bob Chapek explained that their operations have been “hugely impacted” and they are unable to predict when they will be able to resume all of their operations. At the parks, the company may use capacity control strategies and other measures to have a safe environment. ESPN has been affected by the shutdown as it does not have the live sports that it planned to air. Despite not having live sports, the network has been able to have good viewership with events like the NFL Draft and its other sports shows and programs. Studio Entertainment has been significantly affected, just like Disney’s parks and resorts. Movie theaters are not operating around the world and the company has had to defer releases of their movies until the shutdown ends. Some movies like Artemis Foul will now debut exclusively on Disney+ instead of being in theaters first. Disney+ has been the lone bright spot for the company as they have ventured into the Western Europe and India markets during the quarter. In April the company reached 50 million subscribers and as of May 4th, 2020, Disney had 54.5 million customers.

The company saw a negative impact of $1.4 billion from the shutdown of the economy. According to The Walt Disney Company’s CFO and Senior Executive VP, Christine McCarthy, most of the impact was from the firm’s Parks, Experiences, and Products segment ($1 billion). McCarthy also highlighted the moves the company is making to add liquidity. The company has issued $6 billion in term debt, which gave the company $14.3 billion in liquidity at the end of the quarter. After the quarter, Walt Disney Co added $925 million to its term debt and closed on a $5 billion credit facility which has brought the company’s total credit facility availability to $17.25 billion. After the quarterly results announcement, the company announced another bond offering totaling $11 billion according to a prospectus filed with the SEC and reported on by Deadline and other media outlets.

Analyst Expectations

According to CNBC and Refinitiv, Wall Street analysts were expecting revenues of $17.80 billion and earnings per share of $0.89 (comparable EPS). Revenues were 1.2 percent above expectations or nearly inline. Reported comparable EPS was 32.6 percent below expectations, a large miss that was based on the impact that the shutdown had on the company.

The Walt Disney Financial Analysis Q2 2020 (2nd Quarter)

The second quarter of 2020 proved to be the first quarter in a long time where the company missed expectations by a good margin. Revenues came in above analyst expectations; however, comparable EPS missed by a large margin. The economic shutdown was the reason why Disney missed expectations and had a 63 percent decline in comparable EPS when compared to last year. The Walt Disney Company reported that its parks and resorts business, less Hong Kong Disneyland, was already on track to be well ahead of last year’s numbers before the shutdown. Disney also reported that the shutdown was responsible for a $1.4 billion loss in operating income. Parks, Experiences, and Products operating income was negatively affected by $1 billion alone. Even with the large loss of income in the quarter, the company was able to manage to have net income in the quarter.

How Much is the Company Losing?

In the earnings reports, the company did not mention how much it was losing and plans to lose during the shutdown. Before the earnings report, an analyst at Wells Fargo estimated that the company was losing $30 million per day. Based on the $1.4 billion loss that the company reported and the closure of Disneyland and Disney Cruise Line that occurred on March 14th, Disney lost $87.5 million dollars per day. Those numbers are rough estimates based on the time where the shutdown started to significantly impact operations. Walt Disney Co. has reduced the amount that it is losing due to the significant cost-cutting initiatives that have been implemented since they closed their parks and resorts. It is unknown how much the company is losing; however. Based on the capital Disney has raised, it seems that the firm is being very cautious. That may be an indication that the firm is burning through a good amount of cash and wants to ensure that they have enough cash on hand to weather the storm.

Segment Performance

Segment operating income came in at $2.416 billion, a 37 percent decline from last year. Parks, Experiences, and Products had a large decline from last year (58 percent decline). Studio Entertainment was next in the year-over-year losses with an 8 percent decline. Media Networks had a 7 percent increase in operating income compared to last year. Direct-to-Consumer and International had increased losses that were 111 percent higher than last year’s losses. Those losses were expected, however. Revenues for Direct-to-Consumer and International were up 260 percent from last year’s quarter.

Financial Analysis Review

The Walt Disney Company had one of the most challenging quarters in its history. Parks, Experiences, and Products had a very difficult quarter as the parks and resorts were greatly impacted by the economic shutdown. Studio Entertainment was also affected by the shutdown; however, the segment only reported an 8 percent decline in operating income compared to a 58 decline for Parks, Experiences, and Products. Media Networks did have positive operating income growth for the quarter. Disney has entered into a cash-raising mode as a result of the economic shutdown. If Disney can return to normal operations quickly, they will be in much better shape. If the economic shutdown lasts for more than six months, the company could be faced with making difficult choices. The future of The Walt Disney Company is very cloudy as the company works to maintain its operations during the challenging economic shutdown.

Above is a graphic the showing the financial performance of The Walt Disney Company during the 2nd quarter of 2020 by David Aughinbaugh II. Revenue, comparable EPS, and free cash flow are covered in the graphic. Please feel free to share.

Key Information – 2020 Q2 Financial Results

The Walt Disney Company has been greatly impacted by the effects of the economic shutdown. Its Parks and Resorts operations have been impacted the most as a majority of its parks are closed. It is also unknown if guests will return to the parks at levels that the company was experiencing before the shutdown.

- Parks, Experiences, and Products took a $1 billion hit from the shutdown. The entire company lost $1.4 billion as a result of the shutdown. Parks, Experiences, and Products accounted for 71 percent of the loss.

- Parks and Resorts was doing well before the shutdown as guest volume and spending were on track to be higher than last year.

- Studio Entertainment was also impacted by the shutdown; however, the financial impact during the quarter was not as bad as Parks, Experiences, and Products. Revenues were up 18 percent while income was down 8 percent. Legacy operations were the main source of the operating losses as higher impairments and lower theatrical distribution affected the division.

- Media Networks had a good quarter despite the economic shutdown. The segment had a 28 percent increase in revenues and a 7 percent increase in income. The main source of the increase in operating income was due to the consolidation of 21st Century Fox (TFCF) businesses into the segment.

- ESPN, Disney Channel, and Freeform had declines that negatively impacted Media Networks.

- ESPN was hit by higher programming and production costs and lower advertising revenue.

- Media Networks’ Broadcasting division had a good quarter that resulted in a 49 percent increase in revenues and a 53 percent increase in operating income. The consolidation of TFCF and an increase in the company’s legacy operations were behind the positive results.

Direct-to-Consumer and International continued on its trend of increased losses as Disney+’s continued launch affected results. Revenues increased by 260 percent and losses increased by 111 percent. - Disney+ had 54.5 million subscribers as of May 4th, 2020, a 91 percent increase from the last earnings report subscriber count of 28.6 million.

- Cash flow was positive for the quarter even though the company was greatly impacted by the shutdown. Cash provided by operations (cash flow) was down 20 percent and was at $4.787 billion for the quarter. Free cash flow was at $2.202 billion, down 39 percent from last year.

- The company has entered into a defensive mode and is working in an “all-hands-on-deck” mode to ensure that the firm can stay afloat while waiting for the end of the shutdown.

- The future for Disney is very cloudy. The company’s executive team does not have a timeline on when they will be able to open up their parks and resorts.

If the economic shutdown lasts for a long period of time (6 or more months) the firm could be in a bad position economically.

Segment Financial Results and Financial Analysis

Parks, Experiences, and Products

During the quarter, Parks, Experiences, and Products was impacted greatly by the shutdown that occurred near the end of the quarter. Revenues were down 10 percent to $5.543 billion from $6.171 billion in 2019. Operating income was down 58 percent to $639 million from $1.506 billion in 2019. In the middle of March, starting on March 14th, 2020, the company started closing its domestic parks and its cruise line business as a result of the economic shutdown situation. Asian parks and resorts were closed earlier. Before the closure of its parks and resorts, guest spending and volume was tracking to be above last year’s results. Disney reports that the economic shutdown caused the segment to lose $1 billion in operating income for the quarter.

Costs were higher when compared to Q2 2019 as domestic parks’ expenses for new attractions, including Star Wars Galaxy’s Edge, and employee pay for those not performing services, and inflation were higher during the quarter.

For the products side of the segment, its game business had lower income due to the sale of rights to a game last year and lower royalties from Kingdom Hears III. Merchandise licensing operating income was down due to a lower minimum guarantee shortfall recognition and lower revenues from Mickey and Minnie merchandise. The company did see increased revenue from Frozen branded merchandise. Licensing results were also impacted by the effects of the economic shutdown.

Parks, Experiences, and Products had a challenging quarter that was caused by the economic shutdown that lead to the closure of its parks and resorts around the world. The products division also was down year-over-year based on lower revenue from its licensing activities. The shutdown situation led the way as the company had to shut down its parks and resorts and take a major hit to the entire Disney organization.

Above is a photo of the Walt Disney World enterance in Florida by David Aughinbaugh II.

Studio Entertainment

Studio Entertainment was the next segment of the company to be significantly impacted by the economic shutdown. Revenue for the quarter was $2.539 billion, up 18 percent from last year’s $2.157 billion. Operating income was $466 million, down 8 percent from 2019 Q2’s $506 million. The lower operating income was due to the lower income from its main operations (legacy); however, the lower legacy results were slightly offset by the combination of TFCF business into the segment. Legacy operations were impacted by higher film impairments and decreases in theatrical distribution and stage play financial results. The economic shutdown played a big role in the decreased performance of the segment. An increase in bad debt expense and the timing of the release of Onward during the start of the shutdown period also impacted results. TV/SVOD had growth in the quarter that was based on content sales to Disney+, which included sales of Toy Story 4, Frozen II, Aladdin, and The Lion King.

The segment was significantly affected by the shutdown and will continue to be as long as the shutdown remains in place.

Media Networks

Media Networks was the only division to have positive results when compared to last year. Revenues were $7.257 billion for the quarter, an increase of 28 percent from last year’s $5.683 billion. Operating income was $2.375 billion, up 7 percent from $2.230 billion in 2019. The gains in the quarter were due to the consolidation of TFCF operations. Cable Networks revenue for the quarter increased 17 percent to $4.4 billion and operating income increased 1 percent to $1.8 billion. Cable Networks’ ESPN and Disney Channel and Freeform (domestic) had decreases in financial performance. Broadcasting’s revenues were $2.8 billion, an increase of 49 percent, and operating income came in at $397 million, a 53 percent increase. The combination of TFCF businesses (with program sales) and increases at the firm’s legacy operations contributed to the increase in operating income.

Cable Networks Review

Cable Networks was impacted by performance at ESPN, which had higher programming costs and lower advertising revenue. Rate increases for the College Football Playoffs and other college sports were the main reasons why programming costs increased. Lower advertising revenue was caused by lower average viewership; however, the company was able to recoup some of the losses through rate increases. Lower viewership was the result of the cancellation of live sports in March. Disney Channel was impacted by a decrease in affiliate revenue and increased marketing costs. Lower affiliate revenue was caused by a decrease in subscribers. Contracted rates for the channel did increase on the other hand. Freeform was impacted by higher costs, decreased advertising revenue, and increased marketing costs. The decline in advertising revenue was a result of “lower impressions” (decreased viewers?); however, Disney was able to raise rates.

Broadcasting Review

Broadcasting’s results were positively influenced by the inclusion of TFCF operations in its results and an increase in Disney’s legacy operations. Higher affiliate revenue from higher rates and decreased programming and production costs helped to support the gains in the quarter. The rise in operating income was slightly countered by increased network marketing costs and lower sales of ABC Studios programs. Lower programming and production costs were caused by a timing benefit from new accounting guidance. The decline in program sales was due to the year-over-year comparison of two programs in the prior year. The Walt Disney Company did not note that the division was affected by the economic shutdown.

Direct-to-Consumer and International

Direct-to-Consumer and International had another solid quarter of revenue and subscriber gains that was countered by increased losses due to the ramp-up of Disney+. Revenues were $4.1 billion, an increase of $3 billion, or 273 percent. Operating losses increased to $812 million, a $427 million, or a 111 percent increase. Disney+ subscribers for the quarter increased to 33.5 million and was at 54.5 million on May 4th. During last quarter’s earnings conference call, Disney had 28.6 million subscribers for Disney+. As with the prior quarter, the increase in operating loss was due to the costs of launching Disney+ and the combination of Hulu in the segment's results.

The combination of TFCF’s international operations, specifically Star, had a positive contribution to the segment. The average monthly revenue per subscriber for ESPN+ declined from $5.13 to $4.24 as a result of the service being included in a bundle that lowered the monthly revenue that the company receives. Hulu SVOD’s monthly revenue per subscriber declined from $12.73 to $12.06 due to lower pricing for the service.

Equity in the Income of the Investees

Note: This is not a segment and is placed to show how some of the company’s other investments are doing. Most of the performance of this division is contained within the Media Networks segment.

Equity in the income of the investees increased to $135 million from a loss of $309 million in 2019. The reason for the increase was due to the Vice impairment charge that the company took in the prior year and the inclusion of Hulu in the results.

Cash Flow Analysis 2020 Q2

For the quarter, cash provided by operations (cash flow) was $3.157 billion, a 19.4 percent decline from last year’s $3.915 billion. Investments in parks, resorts, and other property increased by $52 million or 4.4 percent. Free cash flow was $1.910 billion, a 30 percent decrease from last year.

Year-to-date, cash provided by operations (cash flow) was $4.787 billion, a 20 percent decline from last year’s $6.014 billion. Investments in parks, resorts, and other property increased by $195 million or 8.2 percent. Free cash flow was $2.202 billion, a 39 percent decrease from last year.

The decrease in cash provided by operations was caused by increased TV and film production spending (TFCF consolidation and Hulu), an increase in TFCF severance payments, higher interest payments, and lower segment operating income. Cash flows were slightly enhanced by lower tax payments.

Overview of the Financial Performance of The Walt Disney Company

The Walt Disney Company had a good start to the quarter. By the end of the quarter, Disney found its self in what may be the most challenging situation that the company has faced in its history. For the quarter, the company’s Parks, Experiences, and Products segment was greatly affected by the economic shutdown and lost $1 billion in income. Studio Entertainment was also greatly impacted as the company had to delay the distribution of films. Media Networks had a decent quarter; however, it was impacted by lower viewership and the loss of live sports. Direct-to-Consumer and International had a good quarter based on revenue and subscriber gains. By May 4th, Disney+ had gained 54.5 million subscribers. Even with the gains that Direct-to-Consumer and International posted, The Walt Disney Company’s future is uncertain and the company finds itself in a very troubling situation.

What to Watch Going Forward – Future Analysis

Going forward, the main focus is the company’s outlook on when it will be able to fully restart operations. Parks, Experiences, and Products will be the main segment to watch as it will continue to impact the company if operations are not able to be restarted soon. If The Walt Disney Company is unable to restart its parks and resort operations in the next couple of months, the company’s financial situation will continue to deteriorate. Disney’s management was not able to give an estimate on when it will reopen the parks. Disney Springs will partially reopen on May 20th. If Disney Springs is able to fully open soon, it will be a good sign for the rest of the company’s operations. Right now, the only important area to watch is the restarting of operations. The company is likely to burn millions of dollars per day to keep the rest of the company afloat. Based on an ultra rough estimate, the company was losing $62.5 to 87.5 million per day when the closures of the parks started. The company has been able to lower its expenses through furloughs and other cost-cutting activities, cash burn has likely deceased by a substantial amount. With continued cash burn, Disney’s future is fully dependent on restarting operations in the near future.

Let's hope that Disney can weather and exit out of this situation.